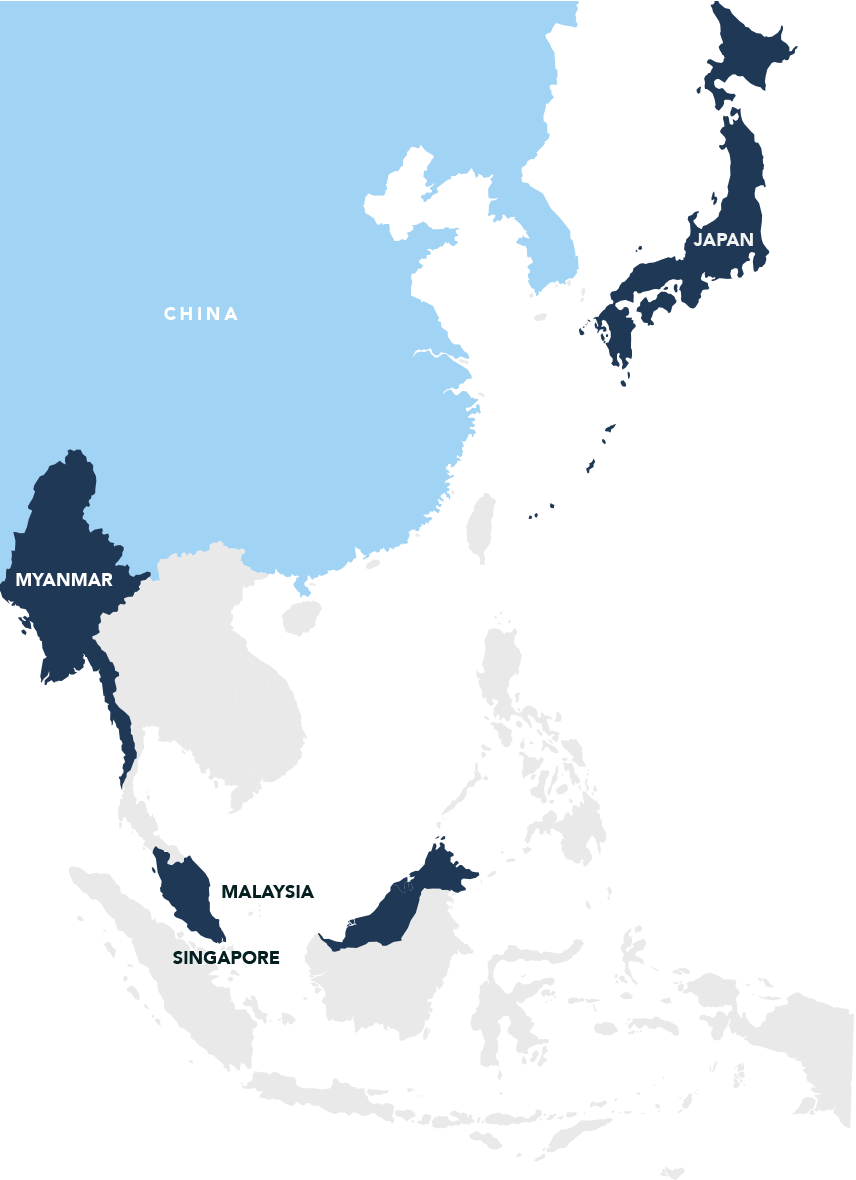

A Growing Network

Size matters, especially when it comes to building a network.

With 726 facilities all across Japan, and in strategic markets in Southeast Asia including Singapore, Myanmar and Malaysia, we’re able to cross new frontiers in modular building units. Our affiliated factory in China is also able to support the demands of the ever-growing market.

0

Company Campuses

0

Sales Offices

0

Self-Storage Facilities

0

Plants

0

Distribution Centres

* As of March 2025.

Overview

Company Name | Sankyo Frontier Co., Ltd. |

Established | December 5, 1969 |

Capital | 1,545.45 million JPY |

Stock | Standard Market of the Tokyo Stock Exchange code : 9639 |

Representative | Takatsugu Nagatsuma, President |

Headquarters | 5 Shintoyofuta, Kashiwa, Chiba, Japan 277-8539 Phone +81-4-7133-6666 Fax +81-4-7131-3289 |

Business Activities | Production, sales and rental of modular buildings, self storage, multistory parking devices, plant factory |

No. of Employees | 1,613 * (Excluding temporary employees, directors, and corporate auditors) * As of April 2025. |

Subsidiaries |

|

Banking |

|

Board Members

President | Takatsugu Nagatsuma |

Managing Director | Takeshi Fujita |

Directors |

|

Outside Directors |

|

Full-time Auditor | Yasuyuki Murai |

Outside Corporate Auditors |

|

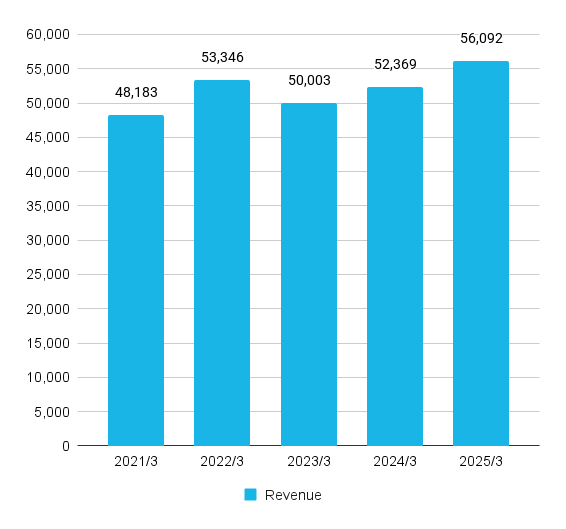

Financial Data

Revenues

(in million yen)

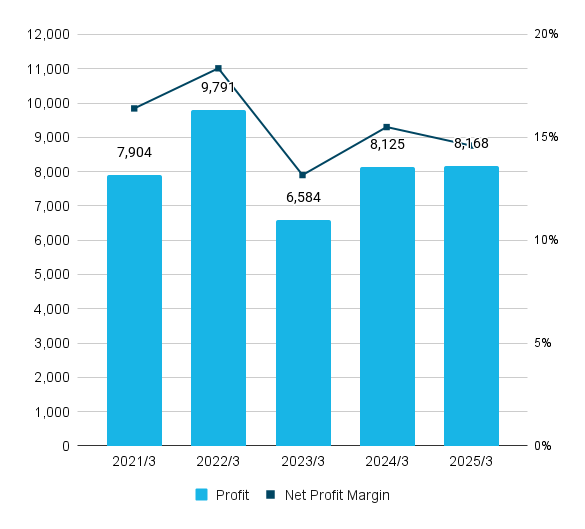

Profit & Net Profit Margin

(in million yen)

2021/3 | 2022/3 | 2023/3 | 2024/3 | 2025/3 | |

|---|---|---|---|---|---|

Revenue | 48,183 | 53,346 | 50,003 | 52,369 | 56,092 |

Operating Profit | 7,904 | 9,791 | 6,584 | 8,072 | 8,021 |

Ordinary Profit | 7,918 | 10,060 | 6,888 | 8,125 | 8,168 |

Profit Attributable to Owners of Parent | 5,102 | 6,353 | 4,337 | 5,287 | 5,502 |

2021/3 | 2022/3 | 2023/3 | 2024/3 | 2025/3 | |

|---|---|---|---|---|---|

Total Assets | 59,234 | 64,494 | 61,118 | 68,586 | 65,331 |

Net Assets | 34,480 | 38,632 | 41,307 | 44,870 | 48,797 |

* in million yen

** The figures shown are consolidated financial results.

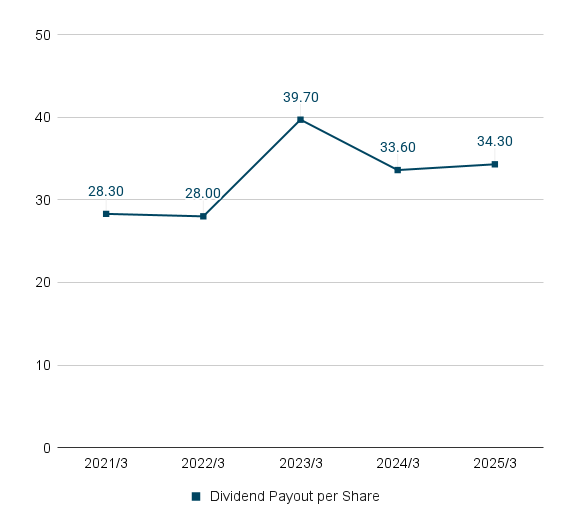

Management Index

Earnings per share

(in yen)

Dividend Payout per share

%

2021/3 | 2022/3 | 2023/3 | 2024/3 | 2025/3 | |

|---|---|---|---|---|---|

Earnings per Share (EPS)

(in yen) | 229.58 | 285.88 | 195.17 | 237.92 | 247.57 |

Book Value per Share (BVPS)

(in yen) | 1,551.40 | 1,738.23 | 1,858.58 | 2,018.92 | 2,195.61 |

Return of Equity (ROE)

(%) | 15.7 | 17.4 | 10.9 | 12.3 | 11.8 |

Capital Ratio (%) | 58.2 | 59.9 | 67.6 | 65.4 | 74.7 |

Dividend Payout Ratio (%) | 28.3 | 28 | 39.7 | 33.6 | 34.3 |

Capital Expenditure

(in million yen) | 6,410 | 7,334 | 8,371 | 9,058 | 7,575 |

Depreciation Expense

(in million yen) | 5,292 | 5,199 | 5,509 | 6,327 | 6,111 |

* On October 1, 2024, the Company executed a 2-for-1 stock split of its common stock. "Earnings per Share" and "Book Value per Share" have been calculated on the assumption that the stock split was effective as of the beginning of the fiscal year ended March 31, 2021.